Boat Industry Search Interest Data: A Hidden Crisis - Consumer Demand is slipping away-how will you respond?

Navigate To Section

- Introduction

- Search Interest Data

- Boat Related Keywords

- Pontoon Boat Related Keywords

- Wakeboard Boat Related Keywords

- Wakesurf Boat Related Keywords

- Wakeboard vs Wakesurf Boat Related Keywords

- Tow-Boat Brands Search Interest Trends

- Ski Boat Related Keywords

- Various Boat Types Related Keywords

- Fishing Boat Related Keywords

- Data Summary & Key Takeaways

- Conclusion

- Search Insights

- How We Can Help

Introduction:

Unveiling the Waves of Consumer Interest: A Comprehensive Analysis of Boating Industry Search Trends, 2004–2024

The boating industry is more than a market, it's a reflection of changing lifestyles, economic conditions, and consumer aspirations. Over the last two decades, search interest data has offered a powerful lens through which to analyze evolving consumer behavior and market dynamics. This white paper delves deep into the trends, peaks, and valleys in search interest for high-intent boating-related keywords, providing actionable insights for businesses navigating this dynamic industry.

Key findings highlight significant trends, such as the surge in outdoor recreational activities during the COVID-19 pandemic and the subsequent normalization period post-2021. The analysis captures the resilience of specific boat categories, such as center console and wakesurf boats, and the challenges faced by legacy brands and high-price segments in retaining consumer interest.

This white paper is more than a collection of data points; it’s a roadmap for understanding the boating industry's past, present, and future. By presenting a detailed exploration of search interest trends, consumer behavior, and economic influences, it equips industry stakeholders with the knowledge to make strategic decisions. Whether you're navigating market saturation, identifying growth opportunities, or planning for seasonal demand, this analysis provides the insights needed to stay ahead of the curve in a competitive and evolving landscape.

Welcome aboard as we chart the course of the boating industry through the lens of two decades of consumer search data, revealing where the tide is turning and how to set sail toward success.

Search Interest Data:

Boat Related Keywords:

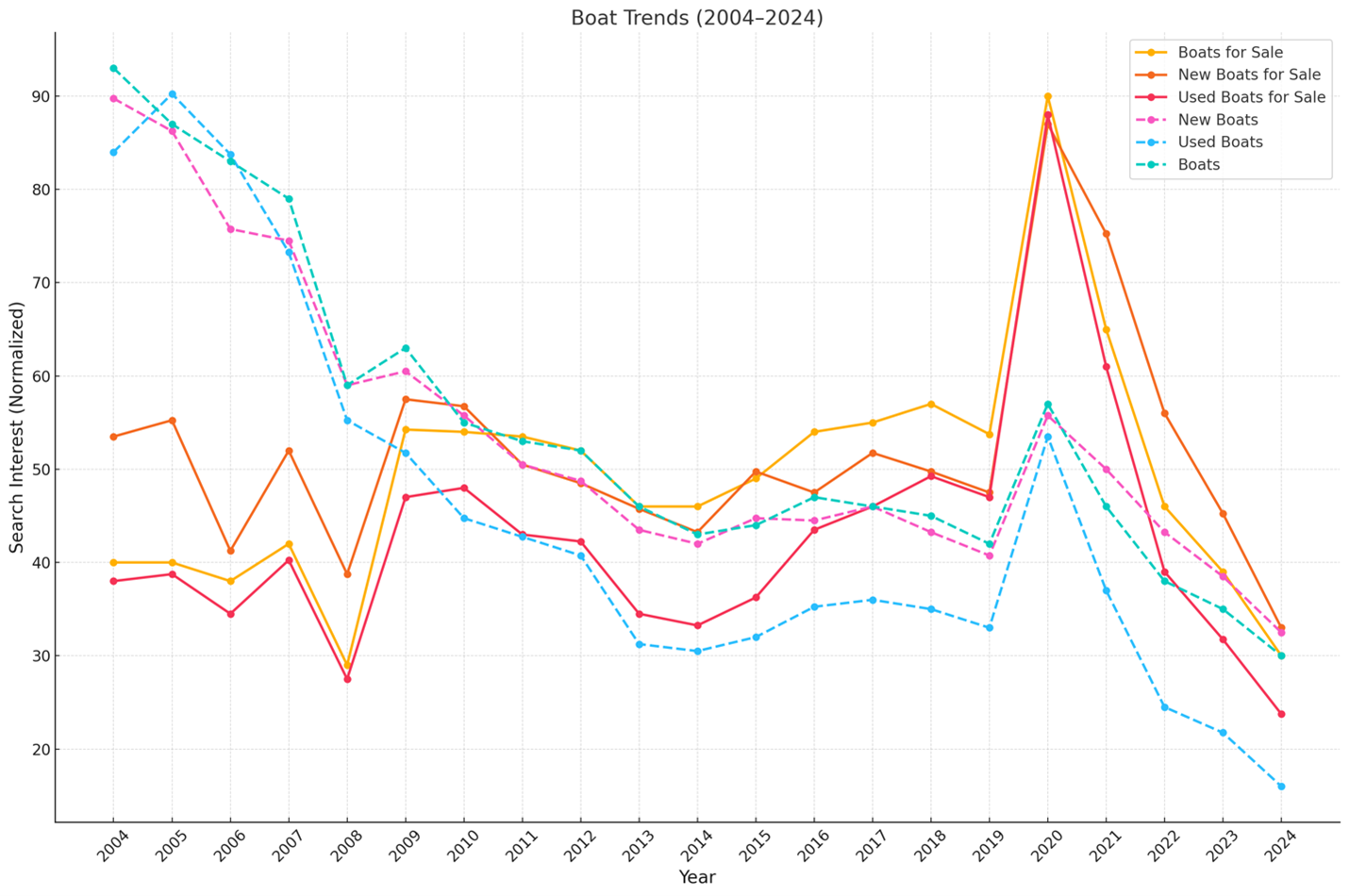

Search Interest Data for High Consumer Intent Boat Related Keywords

This graph illustrates the trends in search interest for high consumer intent boat-related keywords

over

the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Boat Related Keywords

This dataset shows the normalized search interest for various boat-related keywords, including

new

boats, used boats, and boats for sale, from 2004 to 2024.

Below

is a detailed analysis of the trends, consumer behavior, search interest, key observations, and

market

dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

1. General Trends for High Consumer Intent Boat Related Keywords

Peak Years:

1. 2004–2007: Early Stability

-

- Search interest in boats was high and stable in this period, with

Boats peaking at 93 in 2004. - Keywords like New Boats for Sale and Used Boats for Sale

also

had

consistent interest, reflecting strong demand in both new and resale markets.

- Search interest in boats was high and stable in this period, with

2. Decline Consumer Search Interest During Recession (2008–2012):

-

- Interest across high consumer intent keywords declined significantly due to the

2008

financial crisis, with:- Boats (keyword) search interest dropped from 79 in 2007

to

52 in 2012. - Used Boats for Sale (keyword) decreased from 47 in 2009

to

42.25 in 2012.

- Boats (keyword) search interest dropped from 79 in 2007

to

- Interest across high consumer intent keywords declined significantly due to the

2008

3. Gradual Consumer Search Interest Recovery (2013–2019):

-

- From 2013, search interest began recovering gradually, with a notable uptick in 2017 and 2018:

- Boats for Sale (keyword)search interest rose to 57 in

2018,

reflecting growing consumer confidence. - Used Boats for Sale (keyword) saw consistent search interest during

this

period.

- Boats for Sale (keyword)search interest rose to 57 in

2018,

- From 2013, search interest began recovering gradually, with a notable uptick in 2017 and 2018:

4. Pandemic-Driven Boom (2020):

-

- A dramatic surge in search interest occurred during the COVID-19 pandemic:

- Boats for Sale (keyword) search interest reached 90 in

2020,

the highest in the dataset. - Used Boats for Sale (keyword) search interest peaked at

88,

indicating strong interest in secondhand boats.

- Boats for Sale (keyword) search interest reached 90 in

2020,

- The pandemic boosted interest and demand for outdoor, recreational activities, leading to

unprecedented interest across a number of high intent consumer boat related keywords.

- A dramatic surge in search interest occurred during the COVID-19 pandemic:

5. Post-Pandemic Search Interest Decline (2021–2024):

-

- Consumer search interest sharply declined post-2020 across all boat related keywords:

- Boats for Sale (keyword) search interest dropped from 90 in

2020 to 30 in 2024. - New Boats for Sale and Used Boats for Sale (keywords)

also

saw

similar declines.

- Boats for Sale (keyword) search interest dropped from 90 in

- Consumer search interest sharply declined post-2020 across all boat related keywords:

2. Insights by High Consumer Intent Boat Related Keywords

Boats for Sale:

- Pandemic Peak:

- Search interest reached a high of 90 in 2020, driven by increased demand

for

recreational boating.

- Search interest reached a high of 90 in 2020, driven by increased demand

for

- Post-Pandemic Decline:

- Search Interest dropped sharply to 30 in 2024, reflecting reduced

consumer

interest.

- Search Interest dropped sharply to 30 in 2024, reflecting reduced

consumer

New Boats:

- Early Stability:

- Consistently strong search interest from 2004 to 2007, peaking at 89.75 in 2004.

- Pandemic Uptick:

- Moderate search interest growth during the pandemic, reaching 55.75 in 2020.

- Post-Pandemic Decline:

- Search Interest declined significantly to 32.5 in 2024, showing reduced

demand

for

new boats.

- Search Interest declined significantly to 32.5 in 2024, showing reduced

demand

Used Boats:

- Resale Market Strength:

- Consistently high search interest in used boats, reflecting consumer

preference

for

affordability. - Search Interest peaked at 53.5 in 2020, dropping to 16 in 2024.

- Consistently high search interest in used boats, reflecting consumer

preference

New vs. Used Boats for Sale:

- New Boats for Sale:

- Showed steady search interest over time, peaking at 87 in 2020.

- Used Boats for Sale:

- Search interest demonstrated strong demand, reaching 88 in 2020, but

dropped

significantly to 23.75 in 2024.

- Search interest demonstrated strong demand, reaching 88 in 2020, but

dropped

3. Comparative Analysis of Key Phases

| Phase | Trend Observed |

| 2004–2007 | Stable search interest across all high consumer intent boat related keywords, reflecting a

strong search interest and intent for both new and used boat markets. |

| 2008–2012 | Boat related keywords saw a search interest decline due to the 2008 financial crisis, with reduced consumer spending on recreational goods. |

| 2013–2019 | Gradual search interest recovery as the market stabilized, driven by increased confidence

and moderate search interest and search intent growth. |

| 2020 Pandemic Boom | Surge in search interest due to the pandemic, with all high consumer intent boat related

keywords reaching their highest interest levels. |

| 2021–2024 | Sharp search interest declines post-pandemic, reflecting market normalization and reduced discretionary spending. |

4. Economic and Market Dynamics

1. Economic Factors:

-

- The 2008 financial crisis caused a significant drop in search interest,

particularly for new boats, as consumers reduced spending on luxury goods. - The 2020 pandemic acted as a catalyst for growth, with heightened search

interest

in outdoor activities driving boat sales.

- The 2008 financial crisis caused a significant drop in search interest,

2. Consumer Preferences:

-

- Used Boats: Search interest consistently performed well pre-pandemic,

reflecting

cost-conscious behavior. - New Boats for Sale: Experienced a pandemic-driven surge in search interest

but

saw

lower sustained interest post-2020.

- Used Boats: Search interest consistently performed well pre-pandemic,

reflecting

3. Post-Pandemic Market Saturation:

-

- The sharp decline of search interest across all boat related keywords post-2020 suggests

market

saturation, with many consumers already having purchased boats during the pandemic boom.

- The sharp decline of search interest across all boat related keywords post-2020 suggests

market

5. Data-Driven Strategy Insights and Suggestions for the Boat Industry

1. Resale Market Focus:

-

- Strengthen certified pre-owned programs to cater to price-sensitive buyers as the market

stabilizes.

- Strengthen certified pre-owned programs to cater to price-sensitive buyers as the market

2. Innovative Offerings:

-

- Invest in affordability, innovation, features and technology to differentiate from competitors

and

attract families and younger demographics.

- Invest in affordability, innovation, features and technology to differentiate from competitors

and

3. Seasonal Promotions:

-

- Focus marketing efforts during peak boating seasons to maximize interest and sales.

4. Affordable Models:

-

- Introduce entry-level models to capture a broader audience in a more price-sensitive

post-pandemic

market.

- Introduce entry-level models to capture a broader audience in a more price-sensitive

post-pandemic

Conclusion

The boat market has experienced significant fluctuations over the past two decades, driven by

economic

events and consumer trends. While the pandemic created a temporary boom, the market has since

normalized,

with lower interest across all high consumer intent boat related keywords. Businesses should focus

on

affordability, appealing to a larger and broader audiences, innovation, and resale programs to

maintain

growth in the coming years.

Pontoon Boat Related Keywords

Search Interest Data for High Consumer Intent Pontoon Boat Related Keywords

This graph illustrates the trends in search interest for high consumer Intent pontoon boat-related

keywords

over the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Pontoon Boat Related

Keywords

This dataset shows the normalized search interest for high consumer intent pontoon boat-related

keywords,

including Pontoon Boats, New Pontoon Boats, Used Pontoon

Boats,

Pontoon Boats for Sale, New Pontoon Boats for Sale and Used Pontoon Boats for

Sale, from 2004 to 2024. Below is a detailed analysis of the trends, consumer behavior,

search

interest, key observations, and market dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

1. General Trends for High Consumer Intent Pontoon Boat Related Keywords

Peak Years:

1. 2004–2007: Early Growth

-

- Search Interest in pontoon boats began at 55.5 in 2004,

rising

to

a peak of 62 in 2007. - The used pontoon boat market was strong, with search interest levels

consistently

near or above 50 during this period.

- Search Interest in pontoon boats began at 55.5 in 2004,

rising

2. Decline Consumer Search Interest During Recession (2008–2013):

-

- Search Interest in all high consumer intent pontoon boat related keywords declined

significantly

during the 2008 financial crisis, with pontoon boats search

interest

dropping from 62 in 2007 to 47 in 2008 and 50.75 in

2013. - New Pontoon Boats for Sale saw minimal search interest, reflecting

reduced

purchasing power, and or price conscious buyers.

- Search Interest in all high consumer intent pontoon boat related keywords declined

significantly

3. Consumer Search Interest Recovery and Growth (2014–2019):

-

- Search Interest began recovering post-2013, driven by increased consumer confidence.

- In 2016–2018, search interest rose steadily across all high consumer

intent

pontoon

boat keywords, peaking at 70.5 for pontoon boats in 2017.

4. Pandemic-Driven Boom (2020):

-

- A dramatic spike in search interest occurred across all high consumer

intent

pontoon boat keywords during the COVID-19 pandemic:- Pontoon Boats (Keyword) Search Interest peaked at 85 in

2020. - Used Pontoon Boats (Keyword) Search Interest Surged to 86.

- Used Pontoon Boats for Sale (Keyword) Search Interest reached an

unprecedented

106.5.

- Pontoon Boats (Keyword) Search Interest peaked at 85 in

- The pandemic drove interest and demand for recreational activities like boating, as people

sought

safe, outdoor leisure options.

- A dramatic spike in search interest occurred across all high consumer

intent

5. Post-Pandemic Search Interest Decline (2021–2024):

-

- Search Interest sharply declined across all high consumer intent pontoon boat keywords

post-pandemic, reflecting market normalization:- Pontoon Boats (keyword) search interest dropped from 85 in

2020 to 28.25 in 2024. - Used Pontoon Boats for Sale (keyword) search interest fell from

106.5

in 2020 to 20.75 in 2024.

- Pontoon Boats (keyword) search interest dropped from 85 in

- Search Interest sharply declined across all high consumer intent pontoon boat keywords

2. Insights by High Consumer Intent Pontoon Boat Related Keywords

New Pontoon Boats:

- Gradual Growth Pre-2020:

- Search Interest steadily increased from 2004 (0) to 82.25 in

2020,

indicating growing consumer interest in new purchases.

- Search Interest steadily increased from 2004 (0) to 82.25 in

- Post-Pandemic Decline:

- Search Interest dropped significantly after the pandemic peak, reaching 32.25 in

2024.

- Search Interest dropped significantly after the pandemic peak, reaching 32.25 in

Used Pontoon Boats:

- Strong Pre-Pandemic Demand:

- Consistently higher search interest compared to new boats, reflecting a preference for

affordable

options.

- Consistently higher search interest compared to new boats, reflecting a preference for

affordable

- Pandemic Surge:

- Search Interest peaked at 86 in 2020, highlighting robust demand for

secondhand

pontoon boats.

- Search Interest peaked at 86 in 2020, highlighting robust demand for

secondhand

- Post-Pandemic Decline:

- By 2024, search interest fell to 22.5, indicating a weaker resale market.

Pontoon Boats for Sale:

- Steady Interest Pre-2020:

- Maintained moderate search interest, with occasional peaks in 2009 (31)

and

2017 (47.25).

- Maintained moderate search interest, with occasional peaks in 2009 (31)

and

- Pandemic Peak:

- Search Interest peaked at 84 in 2020, driven by heightened consumer demand

for

boating options.

- Search Interest peaked at 84 in 2020, driven by heightened consumer demand

for

- Post-Pandemic Stabilization:

- Search Interest declined to 23.25 in 2024, reflecting reduced consumer activity.

Used Pontoon Boats for Sale:

- Resale Market Dominance:

- The resale market consistently showed strong search interest, peaking at 106.5 in

2020.

- The resale market consistently showed strong search interest, peaking at 106.5 in

- Post-Pandemic Weakness:

- Search Interest dropped sharply to 20.75 in 2024, signaling market saturation.

3. Comparative Analysis of Key Phases

| Phase | Trend Observed |

| 2004–2007 | Gradual growth, reflecting strong search interest in both new and used pontoon boats. |

| 2008–2013 | Search Interest decline due to the 2008 financial crisis, with reduced demand

for both new and used boats. |

| 2014–2019 | Search Interest recovery and steady growth as the market stabilized. |

| 2020 Pandemic Boom | Surge in search interest across all high consumer intent related pontoon boat keywords due

to increased interest in outdoor recreational activities. |

| 2021–2024 | Search Interest had a sharp decline as the market normalized post-pandemic, with weaker

demand across all segments and keywords. |

4. Economic and Market Dynamics

1. Impact of Economic Events:

-

- The 2008 financial crisis resulted in a significant drop in search

interest,

especially for new pontoon boats. - The 2020 pandemic temporarily boosted search interest in pontoon boats as

consumers

prioritized outdoor activities.

- The 2008 financial crisis resulted in a significant drop in search

interest,

2. Shift in Consumer Preferences:

-

- Search Interest for used pontoon boats over new ones was evident

pre-pandemic,

reflecting cost-conscious buying behavior. - Post-pandemic, search interest for both new and used pontoon boats weakened significantly,

likely

due to inflation and economic uncertainty.

- Search Interest for used pontoon boats over new ones was evident

pre-pandemic,

3. Market Saturation:

-

- The sharp decline of search interest post-2020 suggests market saturation, especially in

the

used boat market.

- The sharp decline of search interest post-2020 suggests market saturation, especially in

the

5. Data-Driven Strategy Insights and Suggestions for the Pontoon Boat Industry

1. Target the Resale Market:

-

- Enhance offerings for certified pre-owned boats to attract cost-sensitive buyers.

2. Introduce Affordable Options:

-

- Launch entry-level models with attractive financing options to capture the price-sensitive

segment.

- Launch entry-level models with attractive financing options to capture the price-sensitive

3. Focus on Seasonal Marketing:

-

- Capitalize on boating seasons to boost sales and interest.

4. Leverage Pandemic Gains:

-

- Continue promoting outdoor lifestyle benefits to maintain interest in pontoon boating.

5. Innovate and Diversify:

-

- Introduce entry-level models to capture a broader audience in a more price-sensitive

post-pandemic

market. - Develop innovative features and models to stand out in a competitive market.

- Introduce entry-level models to capture a broader audience in a more price-sensitive

post-pandemic

Conclusion

The pontoon boat market has experienced notable shifts driven by economic events and consumer

preferences.

While the pandemic created a temporary boom, the market is now normalizing. Businesses should focus

on

affordability, appealing to a larger and broader audiences, innovation, and targeting to the resale

markets

to sustain growth in the post-pandemic era.

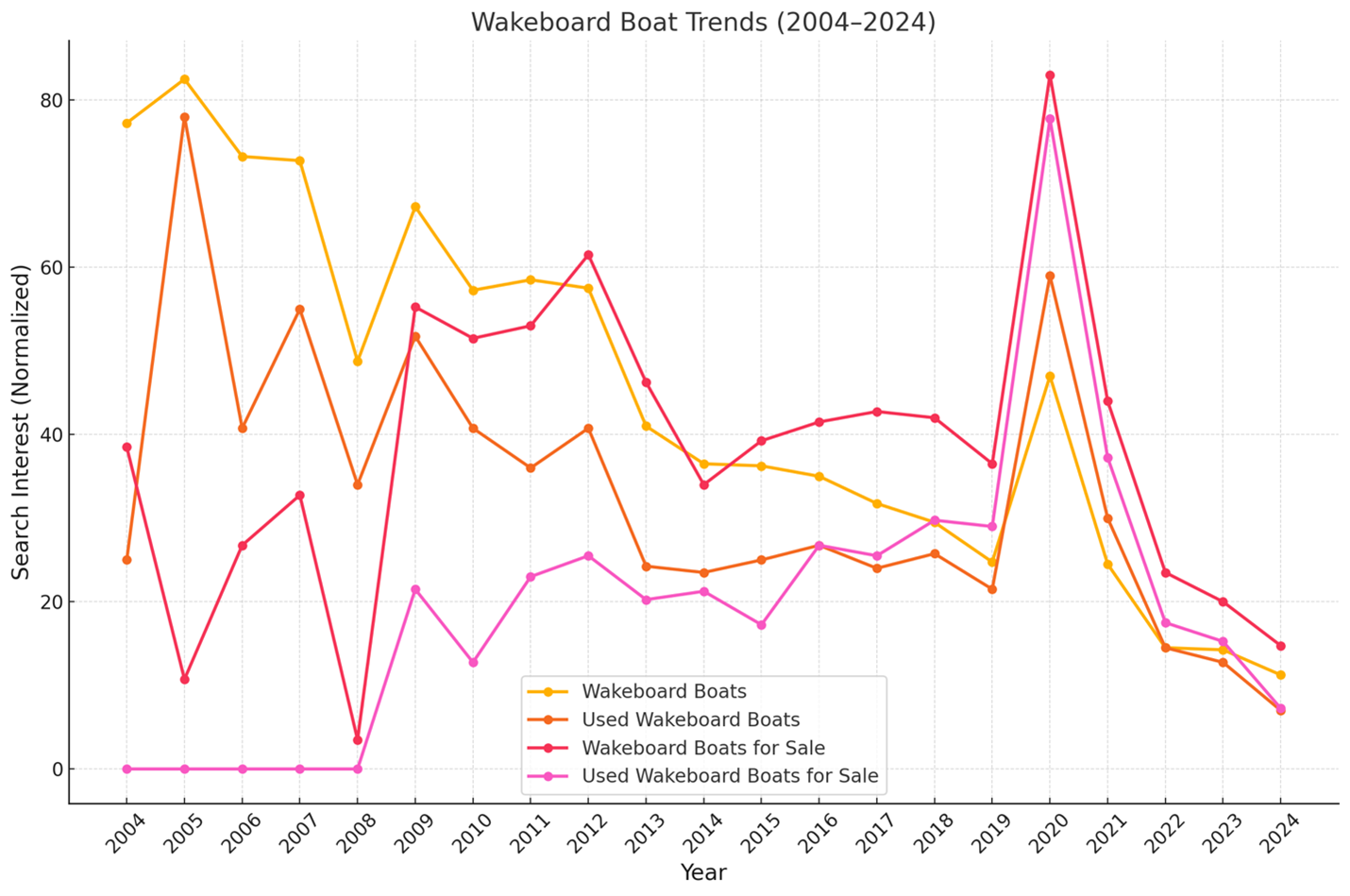

Wakeboard Boat Related Keywords

Search Interest Data for High Consumer Intent Wakeboard Boat Related Keywords

This graph illustrates the trends in search interest for high-intent consumer wakeboard

boat-related

keywords over the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Wakeboard Boat Related

Keywords

This dataset shows the normalized search interest for high consumer intent wakeboard boat related

keywords,

including Wakeboard Boats, Used Wakeboard Boats, Wakeboard

Boats

for Sale, and Used Wakeboard Boats for Sale, from 2004 to 2024. Below is

a

detailed analysis of the trends, consumer behavior, search interest, key observations, and market

dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

Trends for High Consumer Intent Wakeboard Boat Related Keywords

1. Initial High Search Interest (2004–2007):

-

- Wakeboard Boats (keyword) shows a consistently high normalized search

interest

value, peaking at 82.5 in 2005. - Used Wakeboard Boats and Wakeboard Boats for Sale

(keywords)

also

have noticeable search interest during this period, though smaller in scale compared to new

wakeboard

boats.

- Wakeboard Boats (keyword) shows a consistently high normalized search

interest

2. Decline Consumer Search Interest During Recession (2008–2010):

-

- Search Interest had a noticeable drop in search interest across all high consumer intent

related

wakeboard keywords in 2008. For example:- Wakeboard Boats search interest fell to 48.75 in 2008

from

72.75 in 2007. - Used Wakeboard Boats search interest also drops to 34 in

2008.

- Wakeboard Boats search interest fell to 48.75 in 2008

from

- Search Interest had a noticeable drop in search interest across all high consumer intent

related

3. Consumer Search Interest Stabilization and Moderate Increases

(2010–2019):

-

- Search Interest stabilizes at moderate levels, with slight fluctuations year-over-year for

all

high

consumer intent related wakeboard keywords:- Wakeboard Boats search interest fluctuates between 24.75 and

58.5 during this period. - The used market shows consistent search interest, with peaks in 2016 and

2018.

- Wakeboard Boats search interest fluctuates between 24.75 and

- Wakeboard Boats for Sale and Used Wakeboard Boats for

Sale

continue to show steady search interest, reflecting a steady secondary market.

- Search Interest stabilizes at moderate levels, with slight fluctuations year-over-year for

all

4. Pandemic-Induced Surge (2020):

-

- All high consumer intent related wakeboard boat keywords experience a spike in search interest:

- Wakeboard Boats search interest surges to 47 in 2020.

- Used Wakeboard Boats search interest reaches 59 in 2020.

- Wakeboard Boats for Sale search interest peaks at 83 in

2020. - Used Wakeboard Boats for Sale search interest climbs to 77.75

in

2020.

- This surge aligns with the COVID-19 pandemic, when outdoor recreation and

leisure

activities saw significant growth due to travel restrictions and lifestyle changes.

- All high consumer intent related wakeboard boat keywords experience a spike in search interest:

5. Post-Pandemic Search Interest Decline (2021–2024):

-

- Search Interest across all high consumer intent related wakeboard boat keywords declines

sharply

after 2020:- Wakeboard Boats search interest drops from 47 in 2020

to

11.25 in 2024. - The used market also shows steep declines in search interest, with Used

Wakeboard

Boats falling from 59 in 2020 to 7 in 2024.

- Wakeboard Boats search interest drops from 47 in 2020

to

- This decline suggests market normalization and possibly reduced consumer interest or

economic

constraints post-pandemic.

- Search Interest across all high consumer intent related wakeboard boat keywords declines

sharply

Analysis of Market Dynamics

1. Peak Search Interest Driven by External Events:

-

- Searched interest surged in 2020 is likely attributable to the pandemic-driven

lifestyle

changes, where consumers sought outdoor, socially distanced activities like wakeboarding. - The accompanying spike in both new and used boats in search interest indicates a

temporary

increase in demand.

- Searched interest surged in 2020 is likely attributable to the pandemic-driven

lifestyle

2. Economic Influence on Trends:

-

- Search interest sharp declines during 2008–2010 coincide with the global financial

crisis, reflecting reduced consumer spending on non-essential items like recreational

boats. - Similarly, the post-pandemic decline (2021–2024) may be influenced by economic

normalization or reduced discretionary spending due to inflation or recession fears.

- Search interest sharp declines during 2008–2010 coincide with the global financial

3. Steady Secondary Market Development:

-

- The consistent search interest in Used Wakeboard Boats and Used

Wakeboard

Boats for Sale (2010–2019) highlights the growth of a secondary market,

likely driven by affordability and value-conscious buyers.

- The consistent search interest in Used Wakeboard Boats and Used

Wakeboard

4. Long-Term Decline in Search Interest:

-

- The overall trend across all high consumer intent wakeboard boat related keywords from 2004

to

2024

shows a gradual decline, suggesting:- Shift in consumer preferences: Other recreational activities may have

gained

popularity over wakeboarding. - Economic factors: Reduced spending on luxury recreational items.

- Price Conscious Buyers: Price has narrowed audience demographics.

- Market saturation: A significant portion of the target audience has

already

purchased wakeboard boats.

- Shift in consumer preferences: Other recreational activities may have

gained

- The overall trend across all high consumer intent wakeboard boat related keywords from 2004

to

Data-Driven Strategy Insights and Suggestions for the Wakeboard Boat Industry

1. Reframe Perception

-

- Address long-term declines by redefining the wakeboard boat as a versatile multi-sport and

recreational boat, an all-in-one solution for on the water activities. Emphasize its ability to

support a variety of sports and leisure pursuits, including wakeboarding, wakesurfing, water skiing,

foiling, skimboarding, kneeboarding, air chairing, tubing, fishing, cruising, and lounging.

Highlight

user-friendly features like advanced stereo systems, phone charging ports, comfortable seating, and

overall ease of use to position it as the ultimate recreational vessel for any occasion.

- Address long-term declines by redefining the wakeboard boat as a versatile multi-sport and

2. Focus on Innovation:

-

- Focus on innovative features, technology,

multi-sport

functionality, and or new affordable multi-functional models.

- Focus on innovative features, technology,

multi-sport

3. Introduce Affordable Options:

-

- To combat long-term declines, launch entry-level models with more affordable pricing to appeal

to

a

larger and broader audiences.

- To combat long-term declines, launch entry-level models with more affordable pricing to appeal

to

4. Targeting Value-Conscious Buyers:

-

- With the consistent search interest for used wakeboard boats suggests an opportunity to

expand offerings in the secondhand market, such as certified pre-owned programs or

trade-in incentives.

- With the consistent search interest for used wakeboard boats suggests an opportunity to

5. Seasonal and Economic Sensitivity:

-

- Align marketing efforts with peak seasons (e.g., summer) and emphasize versatile multi-sport

and

recreational boat, an all-in-one solution for on the water activities, include affordable

models and options to attract price-sensitive buyers and expand to a larger and broader

audience.

- Align marketing efforts with peak seasons (e.g., summer) and emphasize versatile multi-sport

and

6. Exploration of New Recreational Activities:

-

- In addition to address declining interest driven by shifting consumer preferences, businesses

can

diversify their product offerings by incorporating complementary or alternative recreational options

as part of the boat purchase. This approach broadens appeal, enhances value, and aligns with

evolving

customer interests, creating a more compelling and versatile ownership experience.

- In addition to address declining interest driven by shifting consumer preferences, businesses

can

Conclusion:

The wakeboard boat market shows a lifecycle pattern, with early high interest, a decline during

the

financial crisis, stabilization, a pandemic-driven surge, and a subsequent decline. While the market

has

normalized, opportunities exist to revitalize demand through innovation, value-driven programs, and a

focus

on evolving consumer needs.

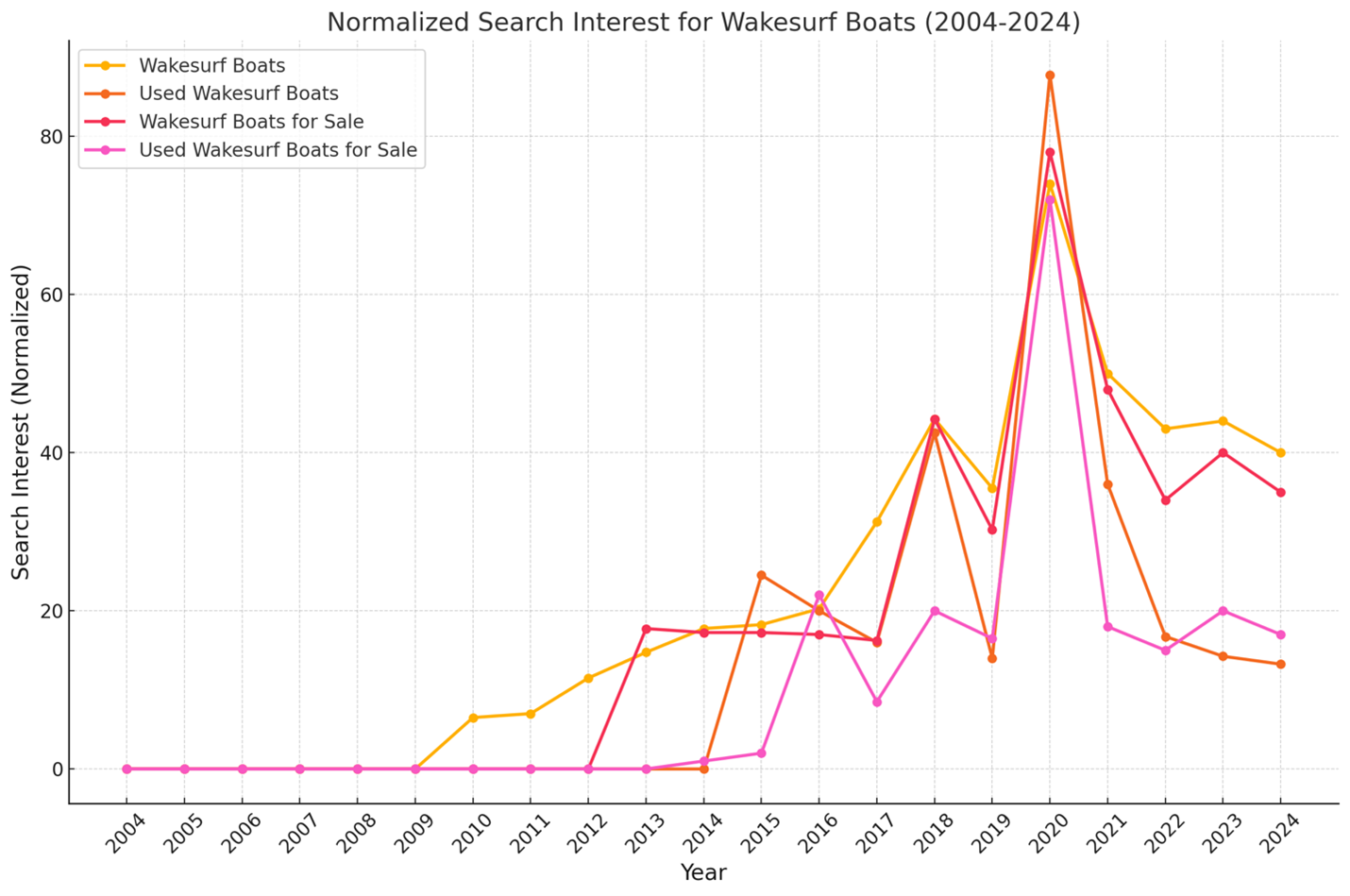

Wakesurf Boat Related Keywords

Search Interest Data for High Consumer Intent Wakesurf Boat Related Keywords

This graph illustrates the trends in search interest for high consumer intent wakesurf boat

related

keywords over the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Wakesurf Boat Related

Keywords

This dataset shows the normalized search interest for high consumer intent wakeboard boat related

keywords,

including Wakesurf Boats, Used Wakesurf Boats, Wakesurf Boats

for

Sale, and Used Wakesurf Boats for Sale, from 2004 to 2024. Below is a

detailed

analysis of the trends, consumer behavior, search interest, key observations, and market dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

Trends for High Consumer Intent Wakesurf Boat Related Keywords

1. Market Growth Over Time (2004–2010):

-

- The search interest across all wakesurf related keywords is negligible or

non-existent until 2010. - In 2010, a small spike in search interest for Wakesurf Boats occurs,

suggesting

the

initial growth of this market.

- The search interest across all wakesurf related keywords is negligible or

2. Gradual Growth Phase (2011–2017):

-

- Search Interest in Wakesurf Boats steadily increases from 2011, reaching

a

notable

peak by 2017 (31.25). This period indicates a growing awareness and interest for

wakesurf boats. - Used Wakesurf Boats (keyword) starts gaining search interest in 2015,

indicating

the emergence of a secondhand market. - Wakesurf Boats for Sale (keyword) begins to show search interest from

2013,

growing

in parallel with general search interest in wakesurf boats. - Used Wakesurf Boats for Sale (keyword) sees slower interest, suggesting that

the

secondhand market is developing at a slower pace.

- Search Interest in Wakesurf Boats steadily increases from 2011, reaching

a

3. Peak Search Interest Growth Period (2018–2020):

-

- 2018 marks a significant surge in search interest across all high consumer

intent

wakesurf boat related keywords, likely due to increased awareness, and popularity of wakesurfing as

a

sport or lifestyle. - By 2020, all high consumer intent wakesurf boat related keywords reach their

highest

levels

of search interest:

- 2018 marks a significant surge in search interest across all high consumer

intent

- Wakesurf Boats (Keyword): Search Interest Peaks at 74 in 2020.

- Used Wakesurf Boats (Keyword): Search Interest Surges to 75 in 2020.

- Wakesurf Boats for Sale (Keyword: Search Interest Peaks at 78 in

2020. - Used Wakesurf Boats for Sale (Keyword): Search Interest Hits 72 in

2020.

-

- This peak coincides with the COVID-19 pandemic, where outdoor

recreational

activities gained immense popularity and saw massive growth due to travel restrictions and lifestyle

changes.

- This peak coincides with the COVID-19 pandemic, where outdoor

recreational

4. Post-Pandemic Search Interest Decline (2021–2024):

-

- A noticeable decline in search interest post-2020 for all wakesurf boat

related

keywords: - After 2020, search interest across all wakesurf boat related keywords declines, with

Used

Wakesurf Boats seeing the sharpest drop in search interest (87.75 in 2020 to 13.25 in

2024). - Wakesurf Boats and Wakesurf Boats for Sale stabilize at

moderate

search interest levels, indicating a sustained but reduced interest. - The used wakesurf boat related keywords experienced a steeper decline in

search

interest compared to new boats or general interest, potentially due to:

- A noticeable decline in search interest post-2020 for all wakesurf boat

related

- Market saturation during the peak.

- Economic constraints impacting purchasing decisions.

- Reduced consumer interest as the market stabilizes.

- Economic factors affecting recreational spending.

- Shift in consumer preferences or priorities post-pandemic.

5. Sustained Search Interest in New vs. Used:

-

- While the used market shows a sharper decline in search interest, new boats

(Wakesurf

Boats

and Wakesurf Boats for Sale) maintain more stable levels of search interest from 2021 to

2024.

- While the used market shows a sharper decline in search interest, new boats

(Wakesurf

Analysis of Market Dynamics:

1. Pandemic-Driven Search Interest Spike:

- The sharp search interest rise during 2018–2020 can be attributed to:

- Increased disposable income for leisure activities during lockdowns.

- A shift to outdoor, socially distanced recreational activities.

- The peak in 2020 surge in search interest for both new and used boat sales due

to

higher demand for boating and wakesurfing activities.

2. Post-Pandemic Search Interest Normalization:

- The decline in search interest from 2021 onwards reflects market normalization:

- Economic changes post-pandemic (inflation, recession fears) may have reduced discretionary

spending. - Market Saturation in audience demographics

- Price has narrowed audience demographics.

- Economic changes post-pandemic (inflation, recession fears) may have reduced discretionary

3. Emerging Secondary Market (Used Boats):

- The used boat market emerged later (2015 onwards), and search interest peaked during the

pandemic,

aligning with cost-conscious consumer behavior. - Post-pandemic, the rapid search interest decline in used boat interest may suggest:

- Saturation of supply (a large inventory of used boats already in circulation).

-

-

- Declining demand as pandemic-driven purchasing subsided.

-

4. Normalization Phase:

- Current levels (2023–2024) indicate the search interest is stabilizing but at lower levels than

during

the 2020 peak. Businesses should adapt to a more competitive and price-sensitive environment.

Data-Driven Strategy Insights and Suggestions for the Wakesurf Boat Industry

1. Focus on New Boats:

- The steady search interest in new wakesurf boats presents an opportunity to highlight

innovative

features and promote multi-sport functionality, making them more appealing to families and first-time

buyers.

2. Introduce Affordable Options:

-

- Launch entry-level models with more affordable pricing to appeal to a larger and broader

audiences.

- Launch entry-level models with more affordable pricing to appeal to a larger and broader

3. Address Market Saturation:

- The steep decline in search interest in used boats suggests a saturated secondary

market.

4. Leverage Seasonal Trends:

-

- As data reflects averages from May to August, businesses should align marketing

efforts

with peak seasons to maximize visibility and conversions. - Analyze seasonal search data to align marketing efforts with high-demand periods.

- As data reflects averages from May to August, businesses should align marketing

efforts

5. Prepare for Economic Sensitivity:

- With discretionary spending impacted by broader economic factors, emphasize versatile multi-sport

and

recreational boat, an all-in-one solution for on the water activities, include affordable models

and options to attract price-sensitive buyers and expand to a larger and broader audience. - Continue focusing on new and innovative features, technology, and multi-sport functionality to

appeal

to

your current audience demographic.

Conclusion:

The data reflects the wakesurf boat market's growth, a pandemic-induced boom, and subsequent

normalization.

While the market appears to be stabilizing at lower levels, there are opportunities to innovate, tap

into

first-time buyers, broaden your audience and address market saturation in the used segment.

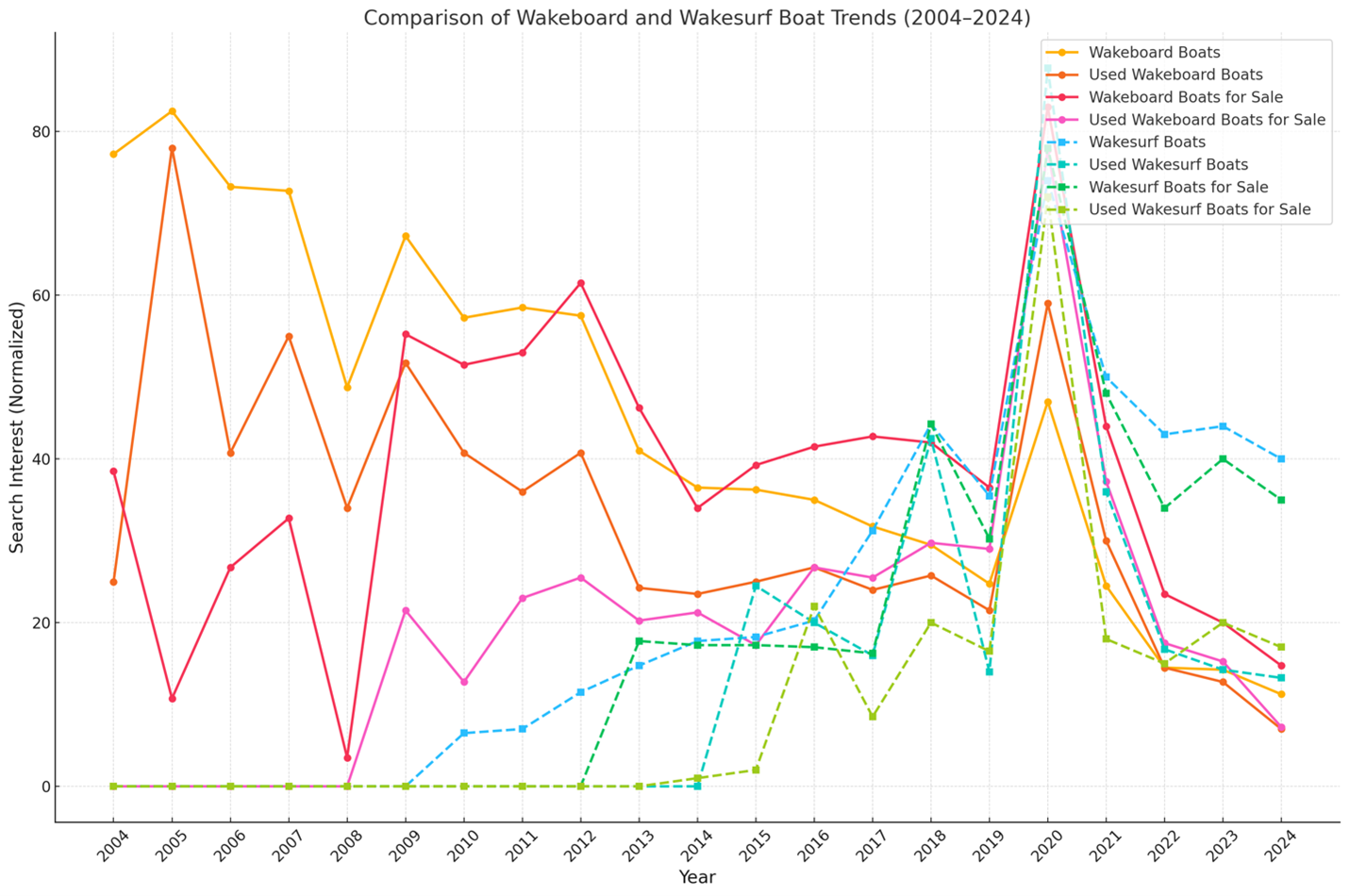

Comparison of Wakeboard and Wakesurf Boat Related Keywords

This visual comparison highlights the trends in search interest for high consumer intent

wakeboard

boats and wakesurf boats realted keywords over the period from 2004 to 2024.

Comparison of Wakeboard and Wakesurf Boat Search Trends

This dataset analyzes and compares the search interest of high consumer intent keywords for both

wakeboard boats and wakesurf boats, we can draw several

comparisons

regarding their search interest trends, market behavior, and consumer preferences.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

1. Market Lifecycles

Wakeboard Boats:

- Early Market Leadership (2004–2007):

- Wakeboard boats show high normalized search interest during the early

years

(2004–2007), peaking in 2005 with a value of 82.5. - This indicates that the wakeboard market was already established and popular during this period.

- Wakeboard boats show high normalized search interest during the early

years

- Gradual Search Interest Decline (2008–2019):

- Post-2007, wakeboard boats show a steady decline in search interest, likely

due

to

market saturation, narrowed audience and the impact of the 2008 financial crisis. By

2019, normalized search interest for wakeboard boats dropped to

24.75.

- Post-2007, wakeboard boats show a steady decline in search interest, likely

due

- Pandemic Search Interest Surge (2020):

- Wakeboard boats saw a significant resurgence in 2020, with search interest

rising

to 47, but this was still lower than its early peaks.

- Wakeboard boats saw a significant resurgence in 2020, with search interest

rising

- Post-Pandemic Search Interest Decline (2021–2024):

- A steep decline in search interest after 2020, with wakeboard boats dropping to 11.25

in

2024, reflecting a continued long-term downtrend.

- A steep decline in search interest after 2020, with wakeboard boats dropping to 11.25

in

Wakesurf Boats:

- Late Market Entry (2010):

- Wakesurf boats began gaining search interest much later, with the first notable search

interest

recorded in 2010 (6.5 normalized).

- Wakesurf boats began gaining search interest much later, with the first notable search

interest

- Rapid Search Interest Growth (2011–2020):

- Unlike wakeboard boats, wakesurf boats experienced strong growth in

search

interest, reaching their peak in 2020 with a normalized search interest of

74. This growth reflects increasing popularity, innovation, and adoption of

wakesurfing as a recreational activity.

- Unlike wakeboard boats, wakesurf boats experienced strong growth in

search

- Post-Pandemic Search Interest Decline (2021–2024):

- Similar to wakeboard boats, wakesurf boats experienced a decline after 2020,

but

their normalized search interest in 2024 (40) remains much higher compared to

wakeboard boats search interest (11.25), indicating sustained interest.

- Similar to wakeboard boats, wakesurf boats experienced a decline after 2020,

but

2. Secondhand Market Search Interest Trends

Wakeboard Boats:

- The used wakeboard boat market search interest peaked early, with normalized

search

interest reaching 78 in 2005, indicating strong demand for secondhand wakeboard boats

during its peak popularity. - Post-2005, the secondary market for wakeboard boats stagnated in search interest

and

saw a slight rise only during the 2020 pandemic surge (59 in 2020). - Search Interest in used wakeboard boats declined significantly by 2024 to

just

7, signaling diminishing activity in the secondhand market.

Wakesurf Boats:

- The secondhand wakesurf boat market search interest emerged much later, with normalized search

interest

starting around 2015 (24.5) and growing steadily. - Search Interest peaked during the pandemic surge in 2020 at

87.75,

surpassing the used wakeboard boat search interest during the same period. - Post-2020, search interest in used wakesurf boats also declined but remains higher than

wakeboard

boats

in 2024 (13.25 for wakesurf boats vs. 7 for wakeboard boats).

3. Boats for Sale Search Interest Trends

Wakeboard Boats:

- Search Interest in wakeboard boats for sale remained moderate throughout, peaking

in

2020 at 83. - Post-2020, search interest has fallen significantly, reaching 14.75 in 2024,

indicating

reduced purchasing activity.

Wakesurf Boats:

- Search Interest in wakesurf boats for sale showed a gradual

rise,

peaking in 2020 at 78. - The post-2020 search interest decline is less severe than wakeboard boats, with 35 in

2024, reflecting sustained buyer interest compared to wakeboard boats.

4. Pandemic Search Interest Impact (2020 Surge)

- Wakeboard Boats:

- The pandemic caused a resurgence in search interest across all wakeboard

boat

related keywords (new, used, and boats for sale). However, this surge was smaller compared to its

early search interest peak years, suggesting it was more of a temporary revival.

- The pandemic caused a resurgence in search interest across all wakeboard

boat

- Wakesurf Boats:

- The pandemic propelled wakesurf boats to their highest search interest levels

ever,

suggesting the sport gained immense popularity during this time, possibly due to innovation,

cultural

trends and multi-sport functionality.

- The pandemic propelled wakesurf boats to their highest search interest levels

5. Long-Term Interest and Sustainability

Wakeboard Boats:

- Wakeboard boats search interest show a declining long-term trend, with their

normalized

search interest dropping significantly from the 2000s to 2024. - The sharp post-pandemic search interest decline suggests waning interest,

possibly

due

to market saturation, niche audience or a shift in recreational preferences or perception.

Wakesurf Boats:

- Wakesurf boats show a more sustained search interest, even after the

post-pandemic

decline. By 2024, their normalized search interest (40) is

significantly

higher than wakeboard boats search interest (11.25). - This indicates a younger and still-developing market, with room for growth

compared

to

the more mature wakeboard boat market.

Key Comparisons at a Glance:

| Aspect | Wakeboard Boats | Wakesurf Boats |

| Market Entry | Established before 2004 | Gained traction in 2010 |

| Peak Interest | 2005 (82.5) | 2020 (74) |

| Pandemic Surge (2020) | Moderate resurgence | All-time high surge |

| Post-Pandemic Decline | Significant and sharp | Decline but more sustained |

| 2024 Interest (New) | 11.25 | 40 |

| 2024 Interest (Used) | 7 | 13.25 |

| Secondary Market | Mature and declining | Still developing and relevant |

Conclusions

1. Wakeboard Boats:

-

- The wakeboard boat market appears saturated and in long-term decline, with

only

brief surges in search interest (e.g., during the pandemic). - Declines in both new and used segments suggest waning consumer search interest.

- The wakeboard boat market appears saturated and in long-term decline, with

only

2. Wakesurf Boats:

-

- Wakesurf boats show a younger and more dynamic market with stronger

sustained

search interest, even after the post-pandemic normalization. - This segment still has potential for growth, particularly in the new boat market with new

features,

innovations, multi-sport functionality and introductions of entry-level models with more affordable

pricing to appeal to larger and broader audiences.

- Wakesurf boats show a younger and more dynamic market with stronger

sustained

3. Overall:

-

- While both markets saw a pandemic-driven surge in search interest, wakesurf

boats

have emerged as the more promising segment for future growth and sustained interest. Businesses may

want to focus more on wakesurf boats and their multi-sport functionality, leveraging their rising

popularity and the younger market lifecycle.

- While both markets saw a pandemic-driven surge in search interest, wakesurf

boats

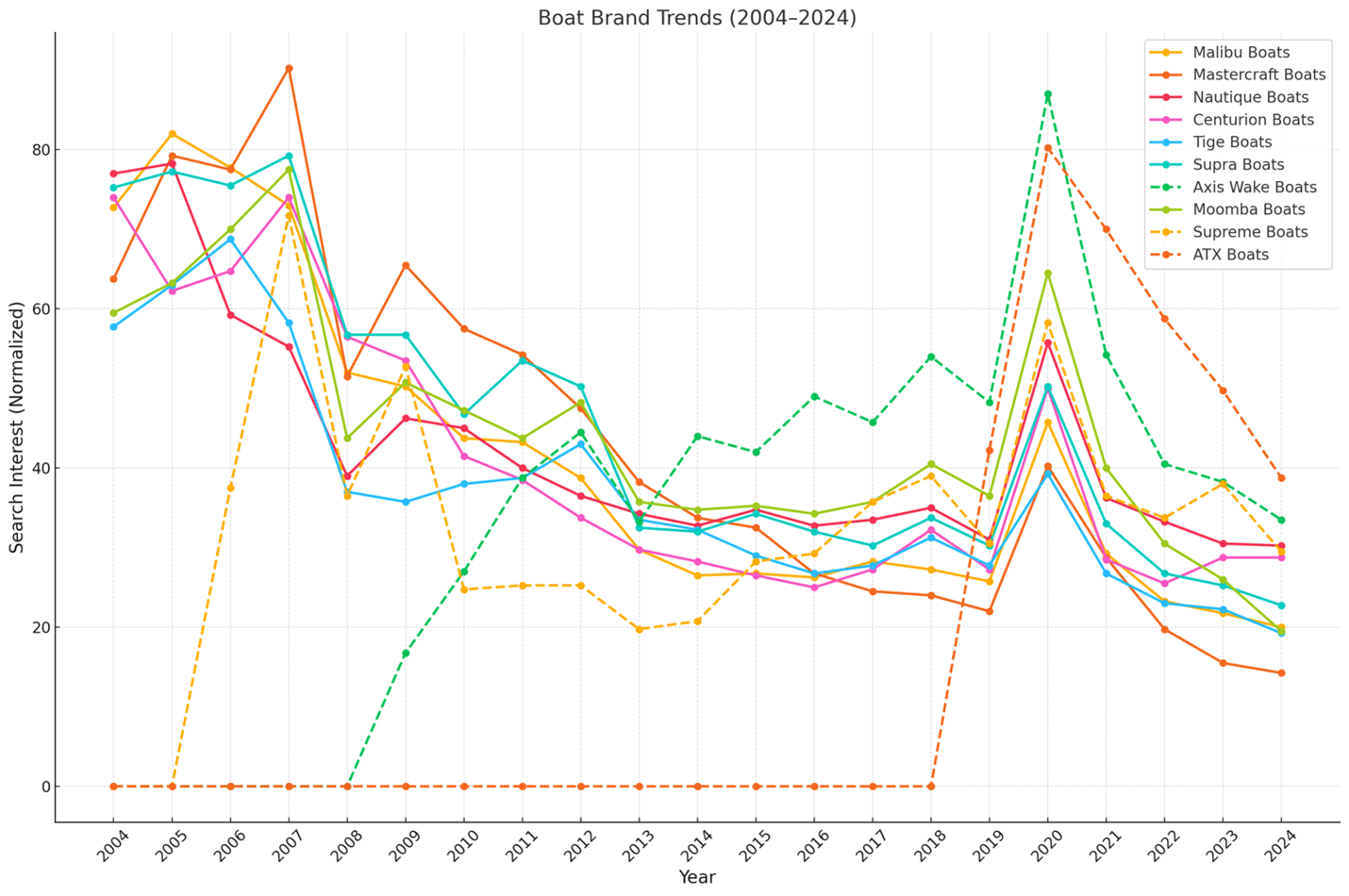

Tow-Boat Brands Search Interest Trends

Here is a comprehensive visual representation of the search interest trends for 10 boat brands from

2004

to

2024. Key insights from the graph:

Wake and Surf Boat Brands

Analysis of Wake and Surf Boat Brands by Search Interest

This data shows the normalized search interest for various wake and surf boat brands (2004–2024) based

on

their search interest over time. The analysis focuses on understanding brand performance trends,

market

shifts, consumer behavior and external influences.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

Search Interest by Brand

Longstanding Leaders (2004–2024):

- Malibu Boats:

- High initial search interest in 2004–2005, peaking at 82 in

2005. - Gradual decline in search interest over time, with some resurgence during the pandemic

(45.75 in 2020). - By 2024, search interest drops to 20, reflecting a

long-term

downward trend.

- High initial search interest in 2004–2005, peaking at 82 in

- Mastercraft Boats:

- Strong search interest performance in 2004–2007, peaking at 90.25

in

2007. - Steady search interest declines post-2007, with modest recovery in 2020

(40.25)

during the pandemic but search interest dropping to 14.25 in 2024, showing

significant market challenges.

- Strong search interest performance in 2004–2007, peaking at 90.25

in

- Nautique Boats:

- Consistently strong search interest early on, with search interest peaking at 78.25

in

2005. - Search Interest remains more stable compared to other brands, with a pandemic surge

(55.75

in 2020) and relatively slower search interest decline afterward (30.25 in

2024).

- Consistently strong search interest early on, with search interest peaking at 78.25

in

Emerging Brands and Pandemic Search Interest Performers:

- Centurion Boats:

- Modest performance pre-2020, with search interest between 25–50.

- Search interest surge during the pandemic (50 in 2020), with sustained

search

interest compared to competitors (28.75 in 2024).

- ATX Boats:

- A newer entrant with notable search interest performance during the pandemic (80.25

in

2020), reflecting rapid interest. - Post-pandemic search interest decline but retains higher search interest levels (38.75

in

2024) compared to other legacy brands, indicating potential as a market disruptor.

- A newer entrant with notable search interest performance during the pandemic (80.25

in

Other Brands:

1. Tige Boats, Supra Boats, Axis Wake Boats, Moomba Boats, Supreme Boats:

-

- All follow similar patterns: steady search interest declines pre-pandemic, a surge in

search

interest in 2020, and varying search interest levels of post-pandemic normalization. - Axis Wake Boats stands out with the highest search interest during the

pandemic

(87 in 2020), reflecting strong interest. - Search Interest in Moomba Boats and Supreme Boats

remains

comparatively moderate but consistent.

- All follow similar patterns: steady search interest declines pre-pandemic, a surge in

search

2. Pandemic-Driven Search Interest Trends (2020 Peak):

- The pandemic acted as a demand catalyst for almost all brands, with the most

significant search interest surges seen in:- Axis Wake Boats (87) and ATX Boats (80.25).

- Legacy brands like Malibu, Mastercraft, and

Nautique also benefited but to a lesser extent.

- This search interest surge was likely due to:

- Increased disposable income from government stimulus programs.

- A shift toward outdoor, socially distanced recreational activities.

3. Post-Pandemic Search Interest Decline (2021–2024):

- Across all brands, there is a noticeable search interest decline post-2020, with some brands

stabilizing

at higher search interest levels than their pre-pandemic performance. - Legacy Brands (Malibu, Mastercraft, Nautique):

- Declining search interest and search trend data point to key factors such as pricing

challenges,

brand shifts toward more niche or narrowed audiences, market maturity, and saturation.

- Declining search interest and search trend data point to key factors such as pricing

challenges,

- Emerging Brands (ATX, Axis):

- Brands with sustained search interest, despite overall declines, are seeing benefits from

more

affordable pricing and appeal to larger, broader audiences.

- Brands with sustained search interest, despite overall declines, are seeing benefits from

more

4. Comparative Analysis of Brand Search Interest Performance

| Brand | Peak Year | 2020 Pandemic Surge | 2024 Normalized Interest | Performance Insights |

| Malibu Boats | 2005 | 45.75 | 20 | Long-term decline: challenged by newer competitors, narrowed audience, and pricing challenges. |

| Mastercraft Boats | 2007 | 40.25 | 14.25 | Strong early lead but sharp decline post-pandemic. Challenged by narrowed audience, and

pricing challenges. |

| Nautique Boats | 2005 | 55.75 | 30.25 | Sustained interest; strongest legacy brand post-pandemic. Challenged by niche audience and pricing. |

| Centurion Boats | 2004 | 50 | 28.75 | Moderate growth and consistent post-pandemic performance. Challenged by narrowed audience,

and pricing challenges. |

| Axis Wake Boats | 2020 | 87 | 33.5 | Pandemic-driven surge; strong post-2020 performance. Opportunity benefits, affordable pricing

and appeal to larger, broader audiences. |

| ATX Boats | 2020 | 80.25 | 38.75 | New entrant with sustained growth; consumer value. Opportunity benefits, affordable pricing

and appeal to larger, broader audiences. |

| Moomba Boats | 2005 | 64.5 | 19.5 | Declining post-pandemic; facing stiff competition. Challenged by narrowed audience and

audience reach. |

| Supreme Boats | 2020 | 58.25 | 29.5 | Moderate growth; sustained interest post-pandemic. Challenged by narrowed audience, and

pricing challenges. |

5. Market Trends and Economic Impacts

1. Legacy Brand Challenges:

-

- Established brands like Mastercraft, Malibu, and Nautique

are

experiencing declining search interest, driven by high pricing, a narrower demographic, market

saturation, and growing competition from more affordable brands targeting a broader audience.

- Established brands like Mastercraft, Malibu, and Nautique

are

2. Value Class Brands Gaining Momentum:

-

- Brands like ATX Boats and Axis Wake are disrupting the

traditional

dominance of legacy brands by offering more affordable boats, appealing to a broader audience, and

aligning with shifting consumer preferences.

- Brands like ATX Boats and Axis Wake are disrupting the

3. Pandemic as a Catalyst:

-

- The pandemic provided a temporary demand boost, but only a few brands

(e.g.,

ATX and Axis) have maintained higher post-pandemic search interest

levels.

- The pandemic provided a temporary demand boost, but only a few brands

(e.g.,

4. Economic Sensitivity:

-

- Rising inflation and reduced discretionary spending have likely contributed to declining

search

interest post-pandemic, especially for premium brands.

- Rising inflation and reduced discretionary spending have likely contributed to declining

search

6. Data-Driven Strategy Insights and Suggestions

1. Legacy Brands:

-

- Repositioning: Focus on affordability and entry-level models to attract

new

buyers

and a broader audience in a price-sensitive market. - Innovation: Focus on developing features that set their boats apart from

newer

competitors, shifting the perception from being designed for one or two specific water sports to

versatile multi-sport functionality. Incorporate leisure, lounging, and comfort features to enhance

appeal and broaden their use cases.

- Repositioning: Focus on affordability and entry-level models to attract

new

2. Emerging Brands:

-

- Expand Reach: Leverage their strong growth momentum in affordability to

increase

a

larger and broader audience. - Sustain Trends: Invest in marketing strategies that highlight affordability

and

unique value propositions.

- Expand Reach: Leverage their strong growth momentum in affordability to

increase

3. Industry-Wide Strategies:

-

- Adapt to Economic Constraints: Introduce entry-level boats at more

affordable

prices to attract and appeal to a larger and broader audience. - Target Younger Audiences: Focus on engaging younger demographics through

digital

marketing efforts and social media.

- Adapt to Economic Constraints: Introduce entry-level boats at more

affordable

Conclusion

The data reflects a dynamic wake and surf boat market, with legacy brands facing challenges from

newer

entrants like ATX and Axis. The pandemic temporarily boosted demand, but post-pandemic interest

levels

suggest that brands must innovate and adapt to changing consumer needs to remain competitive.

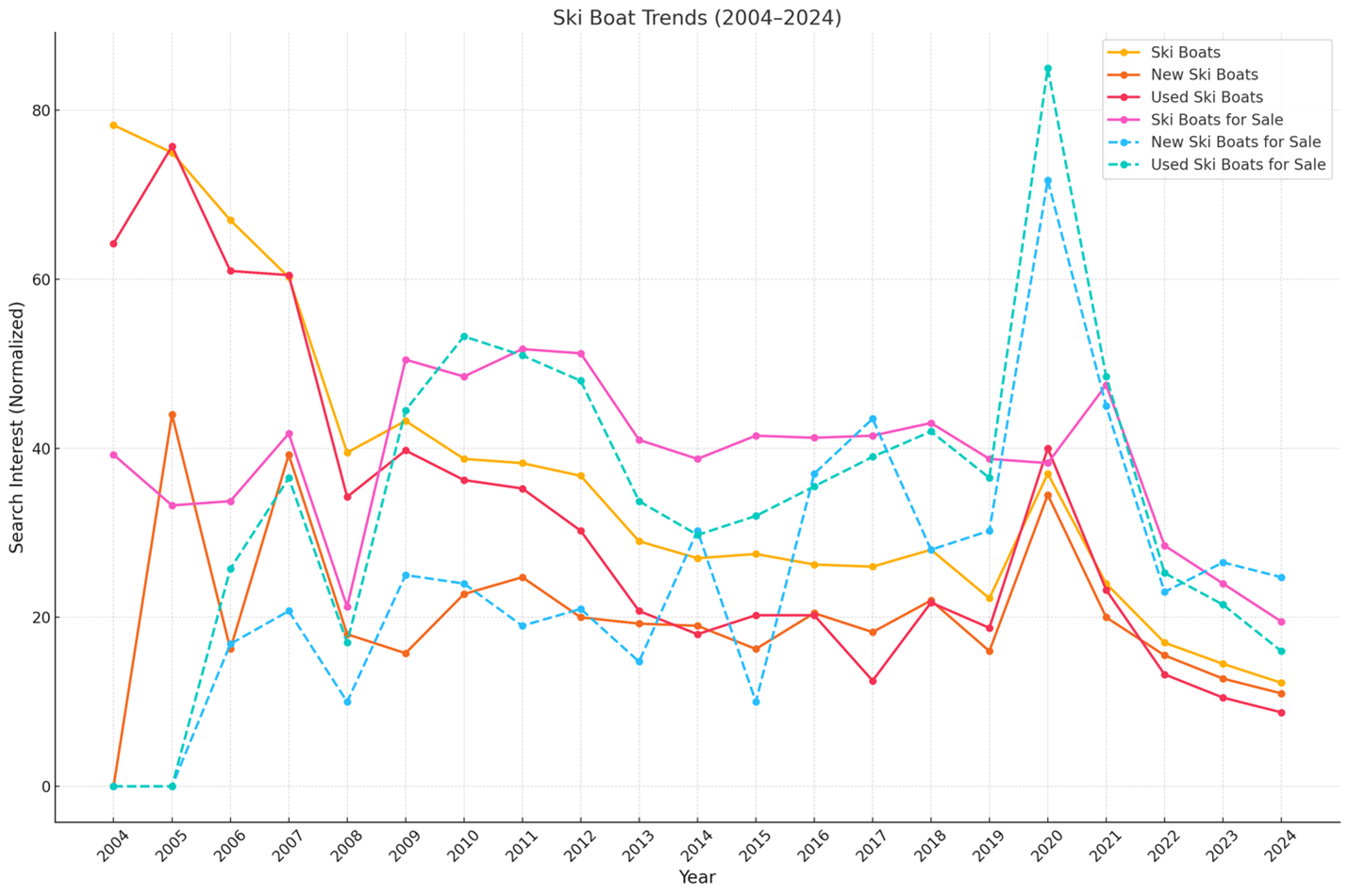

Ski Boat Related Keywords

Search Interest Data for High Consumer Intent Ski Boat Related Keywords

This graph illustrates the trends in search interest for high-intent consumer ski boat related

keywords

over the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Ski Boat Related

Keywords

This dataset shows the normalized search interest for high consumer intent ski boat related

keywords,

including Ski Boats, New Ski Boats, Used Ski Boats, Ski Boats

for

Sale, New Ski Boats for Sale and Used Ski Boats for Sale, from 2004 to

2024.

Below is a detailed analysis of the trends, consumer behavior, search interest, key observations, and

market

dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

1. Trends for High Consumer Intent Ski Boat Related Keywords

Peak Years:

1. 2004–2005: High Initial Demand

-

- Ski Boats (keyword) had strong search interest in 2004

(78.25)

and

2005 (75). - Used Ski Boats (keyword) search interest also peaked in 2005

(75.75), highlighting robust demand in the resale market during this period. - New Ski Boats (keyword) started to see a steady increase in search interest

from

2005 onward, indicating growing appeal for first-time or new buyers.

- Ski Boats (keyword) had strong search interest in 2004

(78.25)

2. Gradual Search Interest Decline (2006–2013):

-

- Search Interest across all related ski boat keywords began to decline

significantly, with Ski Boats search interest dropping from

60.25

in 2007 to 29 in 2013. - The Used Ski Boats segment followed a similar trajectory, reflecting

reduced

overall search interest.

- Search Interest across all related ski boat keywords began to decline

3. Pandemic Search Interest Resurgence (2020):

-

- The COVID-19 pandemic caused a dramatic spike in search interest across all

ski

boat related keywords:- Ski Boats (keyword) Search Interest jumped to 37.

- New Ski Boats for Sale search interest reached a peak of

71.75, while Used Ski Boats for Sale search interest surged to

85.

- This growth can be attributed to the pandemic-driven demand for outdoor and recreational

activities.

- The COVID-19 pandemic caused a dramatic spike in search interest across all

ski

4. Post-Pandemic Search Interest Decline (2021–2024):

-

- A steep decline in search interest is evident across all ski boat related keywords, with

search

interest in Ski Boats falling from 37 in 2020 to 12.25 in

2024. - Used Ski Boats for Sale search interest also dropped sharply from 85

in

2020 to 16 in 2024.

- A steep decline in search interest is evident across all ski boat related keywords, with

search

2. Insights by High Consumer Intent Ski Boat Related Keywords

New Ski Boats:

- Gradual Search Interest Growth Pre-2020:

- Search Interest in new ski boats steadily grew from 2004 (0) to 34.5

in

2020.

- Search Interest in new ski boats steadily grew from 2004 (0) to 34.5

in

- Pandemic Search Interest Peak:

- Search Interest reached an all-time high in 2020 (71.75 for sale),

highlighting

increased interest for new purchases during the pandemic.

- Search Interest reached an all-time high in 2020 (71.75 for sale),

highlighting

- Post-Pandemic Search Interest Decline:

- Search Interest dropped significantly by 2024 (11 for new ski boats,

24.75

new ski boats for sale), likely due to reduced discretionary spending and market

saturation.

- Search Interest dropped significantly by 2024 (11 for new ski boats,

Used Ski Boats:

- Search Interest Peak and Decline:

- Strong search interest performance in 2005 (75.75) and 2007

(60.5). - A sharp search interest decline during 2008–2013, reflecting reduced

purchasing

power post-2008 financial crisis.

- Strong search interest performance in 2005 (75.75) and 2007

- Pandemic Surge:

- A resurgence in search interest during 2020 (40 for used ski boats,

85

used

ski boats for sale).

- A resurgence in search interest during 2020 (40 for used ski boats,

85

- Post-Pandemic Search Interest Normalization:

- By 2024, search interest for used ski boats dropped to 8.75, showing

weakened

resale activity.

- By 2024, search interest for used ski boats dropped to 8.75, showing

weakened

Ski Boats for Sale:

- Consistent Search Interest in the Resale Market:

- Maintained steady levels of search interest across the years, peaking in 2020 (38.25

for

ski

boats). - Post-pandemic, search interest decreased but remained more stable compared to other categories.

- Maintained steady levels of search interest across the years, peaking in 2020 (38.25

for

3. Comparative Analysis of Key Phases

| Phase | Trend Observed |

| 2004–2007 | Strong growth driven by consumer search interest for both new and used ski boats. |

| 2008–2013 | Search Interest decline due to the 2008 financial crisis; demand for discretionary items like ski boats dropped. |

| 2014–2019 | Search Interest stabilization at lower levels, reflecting a maturing market with modest

seasonal interest. |

| 2020 Pandemic Boom | Surge in search interest across all ski boat related keywords due to pandemic-driven interest

in outdoor activities. |

| 2021–2024 | Steep decline in search interest, reflecting reduced discretionary spending and market normalization post-COVID. |

4. Economic and Market Dynamics

1. Impact of Economic Events:

-

- The 2008 financial crisis led to a significant decline in search interest for

the

ski boat market, especially for used ski boats, as consumers cut back on luxury spending. - The 2020 pandemic reversed this trend temporarily, as consumers sought

recreational

activities that allowed for social distancing.

- The 2008 financial crisis led to a significant decline in search interest for

the

2. Shift in Consumer Preferences:

-

- A clear preference for used ski boats over new ski boats

is

evident in the earlier years, reflecting cost-conscious behavior. - During the pandemic, search interest in new ski boats grew substantially,

likely

driven by first-time buyers entering the market.

- A clear preference for used ski boats over new ski boats

is

3. Post-Pandemic Normalization:

-

- The sharp decline in search interest post-2020 reflects market saturation

and

reduced discretionary spending amid inflationary pressures.

- The sharp decline in search interest post-2020 reflects market saturation

and

5. Data-Driven Strategy Insights and Suggestions for the Ski Boat Industry

1. Target the Resale Market:

-

- Focus on certified pre-owned programs to attract cost-conscious buyers as

the

used

boat segment shrinks post-pandemic.

- Focus on certified pre-owned programs to attract cost-conscious buyers as

the

2. Seasonal Marketing Strategies:

-

- Align marketing efforts with high-demand periods, particularly during summer months.

3. Affordable Options:

-

- Introduce more entry-level models to cater to price-sensitive consumers

and

appeal

to a broader audience.

- Introduce more entry-level models to cater to price-sensitive consumers

and

4. Innovation and Sustainability:

-

- Highlight technologically and advanced features to differentiate from competitors and appeal

to

younger buyers.

- Highlight technologically and advanced features to differentiate from competitors and appeal

to

Conclusion

The ski boat market has experienced fluctuations driven by decreased interest, economic events, with

clear

booms during stable periods and the pandemic. However, post-pandemic normalization indicates a

more

challenging market landscape moving forward. Focusing on affordability, innovation, and the resale

market

can help sustain growth.

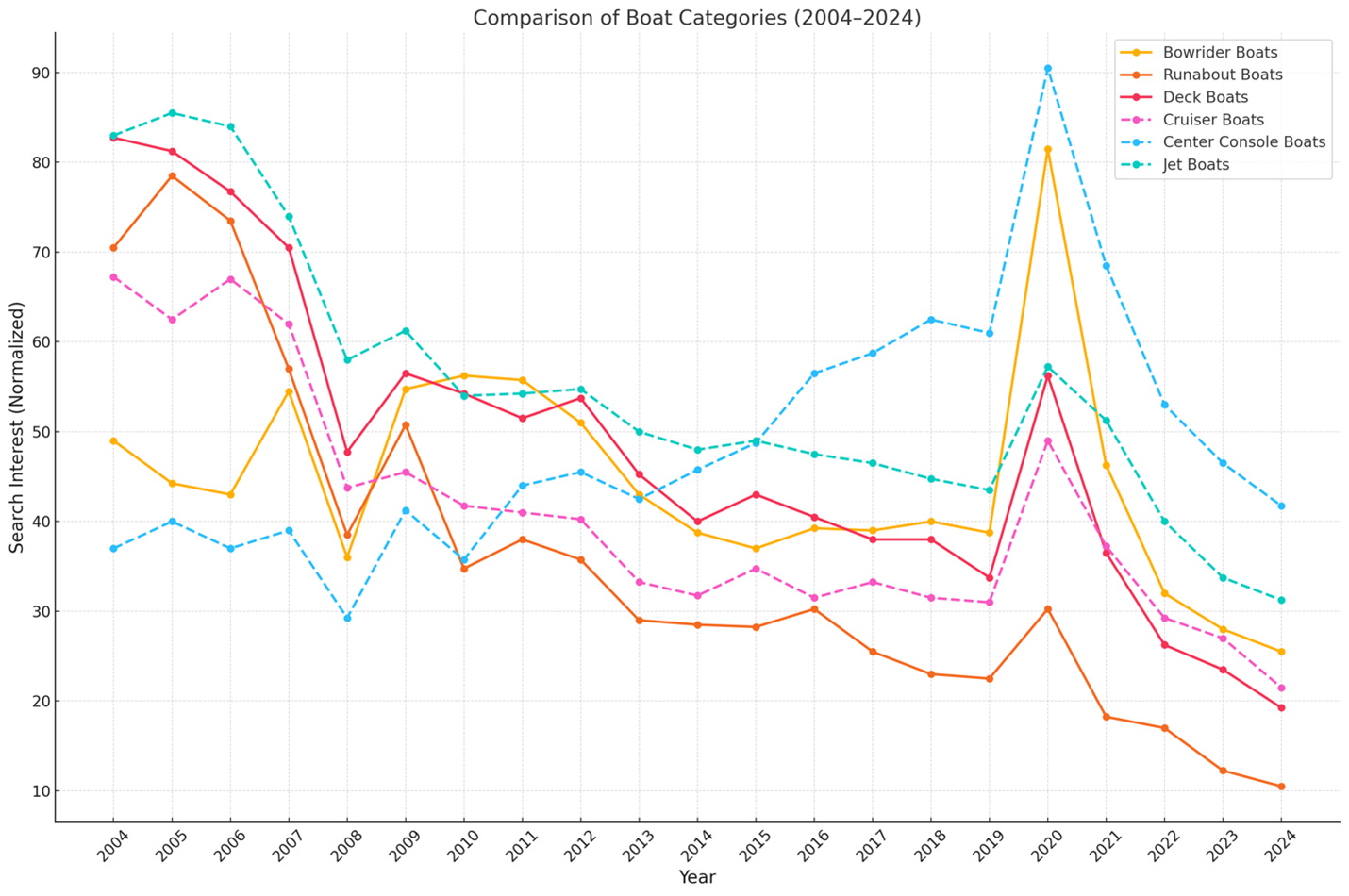

Various Boat Types Related Keywords

Search Interest Data for High Consumer Intent Various Boat Types Related Keywords

This graph illustrates the trends in search interest for high consumer intent various boat types

related

keywords over the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Various Boat Types

Related

Keywords

This dataset shows the normalized search interest for high consumer intent various boat types

related

keywords, including Bowrider Boats, Runabout Boats, Deck

Boats, Cruiser Boats, Center Console Boats, and

Jet

Boats, from 2004 to 2024. Below is a detailed analysis of the trends, consumer behavior,

search

interest, key observations, and market dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

1. General Trends for High Consumer Intent Various Boat Types Related Keywords

Bowrider Boats: Keyword

- Early Stability (2004–2007):

- Search Interest remained stable, peaking at 56.25 in 2010, reflecting

strong

interest during the early 2000s.

- Search Interest remained stable, peaking at 56.25 in 2010, reflecting

strong

- Post-Recession Decline (2008–2014):

- Search Interest declined to 38.75 in 2014, reflecting reduced

discretionary

spending after the 2008 financial crisis.

- Search Interest declined to 38.75 in 2014, reflecting reduced

discretionary

- Pandemic Boom (2020):

- Search Interest peaked at 81.5, reflecting renewed consumer interest during

the

pandemic-driven recreational surge.

- Search Interest peaked at 81.5, reflecting renewed consumer interest during

the

- Post-Pandemic Decline (2021–2024):

- Search Interest dropped sharply to 25.5 in 2024, reflecting market normalization.

Runabout Boats: Keyword

- Peak in Early Years (2005):

- Search Interest peaked at 78.5, showing strong interest during a stable

economic

period.

- Search Interest peaked at 78.5, showing strong interest during a stable

economic

- Steady Decline Post-Recession (2008–2019):

- Search Interest dropped steadily to 22.5 in 2019, reflecting waning

consumer

interest.

- Search Interest dropped steadily to 22.5 in 2019, reflecting waning

consumer

- Pandemic Bump (2020):

- Search Interest had a modest increase to 30.25 in 2020, but the rebound

was

weaker

than other categories.

- Search Interest had a modest increase to 30.25 in 2020, but the rebound

was

- Significant Post-Pandemic Decline:

- Search Interest fell to 10.5 in 2024, reflecting reduced demand for this

category.

- Search Interest fell to 10.5 in 2024, reflecting reduced demand for this

Deck Boats: Keyword

- Early Dominance (2004–2007):

- Strong Search Interest, peaking at 82.75 in 2004, indicating high popularity.

- Gradual Decline (2008–2019):

- Search Interest declined to 33.75 in 2019, reflecting reduced spending on

this

segment.

- Search Interest declined to 33.75 in 2019, reflecting reduced spending on

this

- Pandemic Surge (2020):

- Search Interest surged to 56.25, driven by the outdoor recreational boom.

- Post-Pandemic Drop:

- Search Interest dropped to 19.25 in 2024, showing significant decline.

Cruiser Boats: Keyword

- Early Popularity (2004–2007):

- Maintained stable search interest, peaking at 67.25 in 2004.

- Post-Recession Decline:

- Search Interest declined steadily to 31 in 2019 due to reduced demand for

larger,

more expensive boats.

- Search Interest declined steadily to 31 in 2019 due to reduced demand for

larger,

- Pandemic Revival (2020):

- Search Interest rose to 49 in 2020, indicating moderate recovery.

- Post-Pandemic Decline:

- Search Interest declined further to 21.5 in 2024, indicating weakened

long-term

demand.

- Search Interest declined further to 21.5 in 2024, indicating weakened

long-term

Center Console Boats: Keyword

- Gradual Growth Pre-Pandemic (2004–2019):

- Search Interest grew steadily, peaking at 62.5 in 2018, reflecting

sustained

demand.

- Search Interest grew steadily, peaking at 62.5 in 2018, reflecting

sustained

- Pandemic Boom (2020):

- Search Interest Peaked at 90.5, showing the highest growth among all

categories

during the pandemic.

- Search Interest Peaked at 90.5, showing the highest growth among all

categories

- Post-Pandemic Normalization:

- Search Interest declined to 41.75 in 2024, showing moderate sustained interest.

Jet Boats: Keyword

- Early Popularity (2004–2007):

- Maintained strong search interest, peaking at 85.5 in 2005.

- Post-Recession Decline (2008–2019):

- Search Interest declined steadily to 43.5 in 2019.

- Pandemic Surge (2020):

- Search Interest surged to 57.25, reflecting renewed demand.

- Post-Pandemic Decline:

- Search Interest dropped to 31.25 in 2024, indicating reduced demand.

2. Comparative Analysis of Key Phases

| Phase | Trend Observed |

| 2004–2007 | Strong search interest for all categories, with Deck Boats and

Jet Boats dominating. |

| 2008–2014 | Search Interest declined across all categories due to the 2008 financial

crisis and reduced discretionary spending. |

| 2015–2019 | Stabilization with moderate search interest for Center Console Boats and Cruiser Boats. |

| 2020 Pandemic Boom | Surge in Search Interest for all categories, with Center Console Boats

and Deck Boats seeing the highest growth and interest. |

| 2021–2024 | Sharp Search Interest decline across all categories, reflecting market normalization and

reduced interest. |

3. Insights by Various Boat Types Related Keywords & Categories

Center Console Boats:

- Showed the strongest search interest during the pandemic, indicating increased consumer preference

for

versatility and functionality. - Sustained higher search interest post-pandemic compared to other categories.

Deck Boats:

- Historically one of the most popular categories but faced significant search interest declines

post-2020.

Jet Boats:

- Maintained consistent search interest pre-pandemic, with a moderate resurgence in 2020.

Cruiser Boats:

- More expensive and luxury-oriented, showing weaker recovery and sharper search interest

declines

post-pandemic.

4. Data-Driven Strategy Insights and Suggestions

1. Focus on Versatile Categories:

-

- Prioritize Center Console Boats, which show sustained search interest

even

post-pandemic.

- Prioritize Center Console Boats, which show sustained search interest

even

2. Expand Marketing for Affordable Options:

-

- Emphasize affordability and value for Runabout Boats and Bowrider

Boats to attract cost-conscious buyers and expand to a broader audience.

- Emphasize affordability and value for Runabout Boats and Bowrider

3. Seasonal Promotions:

-

- Leverage peak boating seasons to boost search interest and sales, particularly for

Deck

Boats and Jet Boats.

- Leverage peak boating seasons to boost search interest and sales, particularly for

Deck

4. Innovate and Differentiate:

-

- Develop and innovate new affordable models, innovate new features and technology to appeal

a

broader

audience and capture emerging market trends

- Develop and innovate new affordable models, innovate new features and technology to appeal

a

Conclusion

The dataset highlights significant shifts in consumer search interest, influenced by economic events

like

the 2008 recession and the 2020 pandemic. While the pandemic drove temporary spikes in demand,

most

categories are experiencing post-pandemic search interest declines, with Center Console

Boats showing the most resilience. Businesses should focus on affordability, versatility,

and

innovation to sustain growth in a challenging market.

Fishing Boats Related Keywords

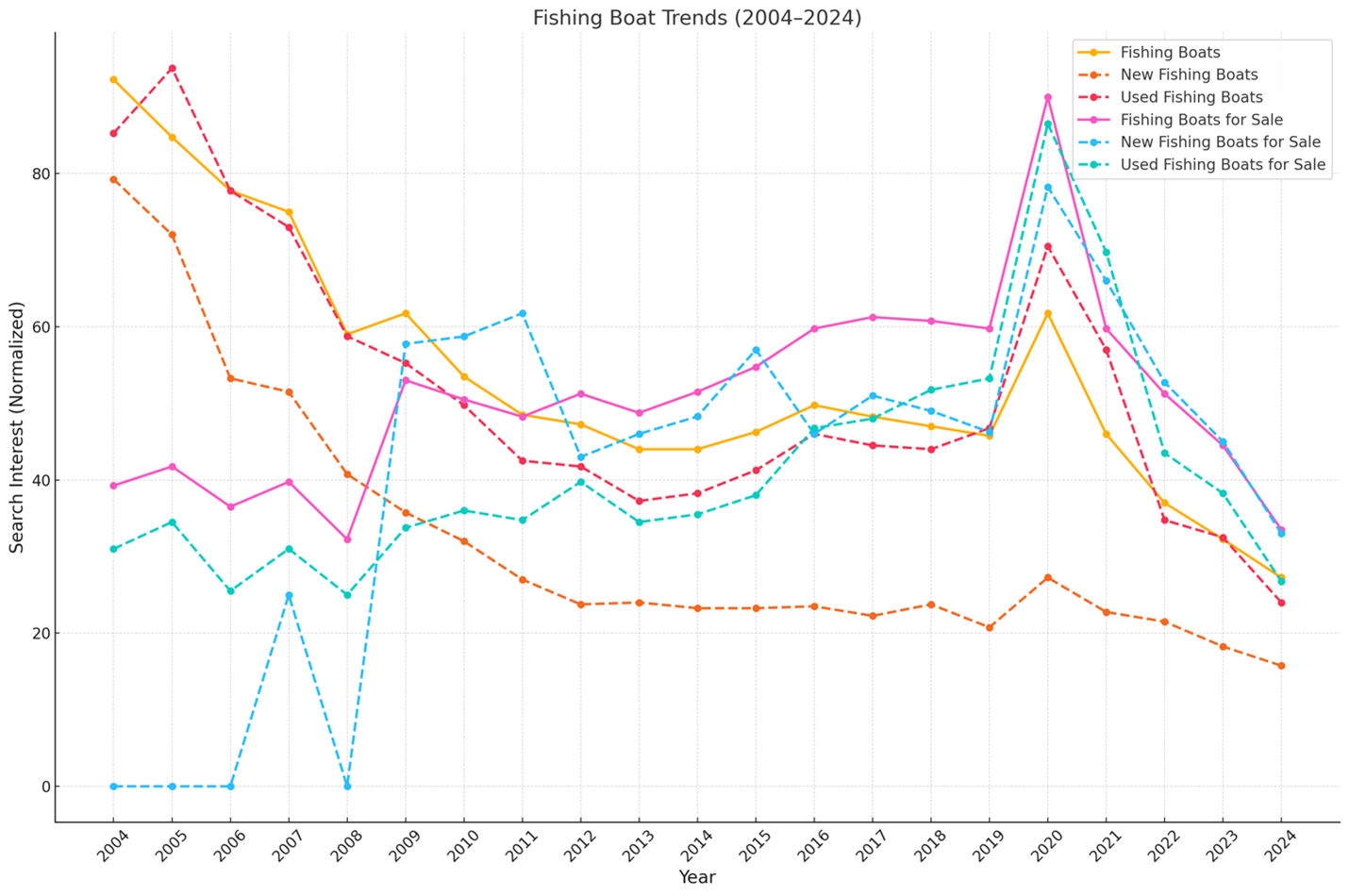

Search Interest Data for High Consumer Intent Fishing Boat Related Keywords

This graph illustrates the trends in search interest for high-intent consumer fishing boat related

keywords

over the period from 2004 to 2024.

Analysis of Search Interest and Trends, for High Consumer Intent Fishing Boat Related

Keywords

This dataset shows the normalized search interest for high consumer intent fishing boat related

keywords,

including Fishing Boats, New Fishing Boats, Used Fishing

Boats,

Fishing Boats for Sale, New Fishing Boats for Sale and Used Fishing Boats for

Sale, from 2004 to 2024. Below is a detailed analysis of the trends, consumer behavior,

search

interest, key observations, and market dynamics.

Scale & Graph: Search Interest by Keywords (Normalized on a Scale of 0-100)

Data Source: Google, Google Trends (Search Interest by Keyword)

Data: United States

1. General Trends for High Consumer Intent Fishing Boats Related Keywords

Peak Years:

- 2004–2005: Search Interest for fishing boats were highly popular, peaking at

92.25 in 2004, driven by a robust economy and consumer interest in recreational

fishing. - 2020 Pandemic Boom: Search interest surged significantly to

61.75

for

fishing boats and 70.5 for used fishing boats during the COVID-19 pandemic, as outdoor

activities gained popularity.

Decline Consumer Search Interest During Recession and Post-Recession:

- From 2006 to 2014, search interest declined across all high consumer intent fishing boat

related

keywords due to the 2008 financial crisis and its aftermath. This reflects reduced discretionary

spending

on recreational items.

Pandemic Surge (2020):

- Fishing boats experienced a resurgence in search interest during the pandemic, with:

- Fishing Boats for Sale (keyword) Search interest peaking at 90.

- Used Fishing Boats for Sale (keyword) Search Interest reaching

86.5. - New Fishing Boats for Sale (keyword) Search Interest increasing to

78.25, indicating a balanced demand across new and used options.

Post-Pandemic Decline (2021–2024):

- A sharp decline in search interest occurred post-2020, reflecting market normalization and

reduced

discretionary spending:- Fishing Boats: (keyword) Search Interest fell from 61.75 in

2020

to 27.25 in 2024. - Used Fishing Boats for Sale: (keyword) search interest declined from

86.5

in 2020 to 26.75 in 2024.

- Fishing Boats: (keyword) Search Interest fell from 61.75 in

2020

2. Insights by High Consumer Intent Fishing Boat Related Keywords

Fishing Boats (General):

- Pre-2008: Strong search interest, with fishing boats peaking at 92.25

in

2004. - Post-Recession Decline: Search Interest fell sharply after the 2008 crisis,

reaching

44 in 2014. - Pandemic Peak: Fishing Boats search interest surged to 61.75 in

2020,

reflecting renewed consumer interest in fishing. - Post-Pandemic Decline: By 2024, search interest dropped significantly to

27.25.

New Fishing Boats:

- Early Stability: High search interest pre-2008, peaking at 79.25 in

2004. - Steady Decline Post-2008: Search Interest declined consistently, reaching

15.75

in 2024. - Pandemic Spike (2020): Search Interest rose to 27.25,

reflecting

increased interest from new buyers.

Used Fishing Boats:

- Dominant Pre-Pandemic Category: Strong Search Interest, peaking at 93.75

in

2005. - Pandemic Boom: Search Interest surged to 70.5 in 2020, as

buyers

opted

for cost-effective secondhand options. - Post-Pandemic Decline: Search Interest dropped to 24 in

2024,

signaling saturation in the resale market.

Fishing Boats for Sale:

- Peak in 2020: Search Interest reached an all-time high of

90,

highlighting the demand for both new and used options. - Steady Decline Post-Pandemic: Search Interest fell to 33.5 in

2024,

reflecting reduced demand.

New Fishing Boats for Sale:

- Pandemic-Driven Growth: Search Interest peaked at 78.25 in

2020,

reflecting significant interest for first-time purchases. - Post-Pandemic Decline: Search Interest Fell to 33 in 2024,

indicating

decreased interest.

Used Fishing Boats for Sale: